One of the first decisions you’ll face when investing in property is choosing between commercial real estate vs residential real estate. Each option has its pros and cons. Being familiar with the significant differences between the two may assist you in making a more informed choice.

Understanding Residential Property Investment

Residential properties are houses and apartments that people use as residences. Investors highly prefer these options because they provide consistent and secure rental income. Moreover, residential real estate grows with time, and its growth will be long-term.

The first advantage of residential real estate investment is the demand. People will always need places to live, and properties in prime locations can provide stable, predictable rental income. Residential properties are usually easier to run than commercial ones. There is a tendency to reduce tenant turnover, and maintenance costs are generally manageable.

However, residential properties have some risk factors. Market change may influence rental prices and property value, affecting your investment property’s income. Though less significant, tenant turnover can create vacancy periods, hence temporary income loss. Moreover, as the property owner, you will find that maintenance and repairs are costly and time-consuming.

Understanding Commercial Property Investment

Commercial properties include office buildings, retail spaces, industrial warehouses, and mixed-use buildings. These investments are usually pricier than residential properties but have the prospect of greater returns. One of the primary benefits of commercial real estate is the stability of long-term leasing. Business residents tend to be less prone to quitting, providing them with more income security.

In addition, commercial properties typically produce better returns than residential properties. Companies enter into long-term leasing agreements, ensuring the rent is more regular.

But commercial properties do not go without their hassles. The starting-up capital is much greater, and the possibility of vacancies may affect the cash flow, especially during bad economic times.

Commercial space is directly connected to the economic environment; recessions can increase vacancy rates and cause loss of rental income. Commercial property management is also a more complicated process requiring more effort to identify tenants, negotiate contracts, and deal with legal matters.

Residential vs. Commercial Investment Compared

Whether you invest in residential or commercial properties depends on your investment objectives. Residential real estate is a good option that provides the best investment opportunity to investors who prefer long-term growth with reduced risk, as it offers stable and predictable returns and is hands-off. However, commercial properties target individuals who can afford to take greater risks, possibly for greater returns because of longer leases and greater rental rates.

Homes offer stable earnings and reduced risk, whereas commercial investments are likely to earn higher profits but need additional participation. Other factors include the fact that residential properties can be sold faster than commercial properties, which are more challenging to sell, particularly when the economy is slow.

Location, real estate market trends, budget, and economic outlook are other factors. Housing properties require lower capital and work well even when the economy is performing poorly, whereas commercial properties require more capital and do well when the economy is booming.

Conclusion

There are special advantages and threats of both residential and commercial properties. Residential homes are inclined to give stable rental property investment, minimum risk, and long-term growth, which makes them ideal when selecting a property to ensure a stable investment. Nevertheless, commercial properties are also more beneficial, yielding better returns. They are initially more expensive and challenging to manage. Anyway, your right investment is always based on your financial goals, risk tolerance, and financial resources.

Residential holdings better suit low-risk and predictable returns than commercial holdings, which are the most suitable in cases where investors want higher rewards and can manage more complex management. Market research should be done well in any direction you want to go, and long-term financial objectives should also be taken into account. The right property investment through renting can be a good tool for sustainable economic growth.

Read More

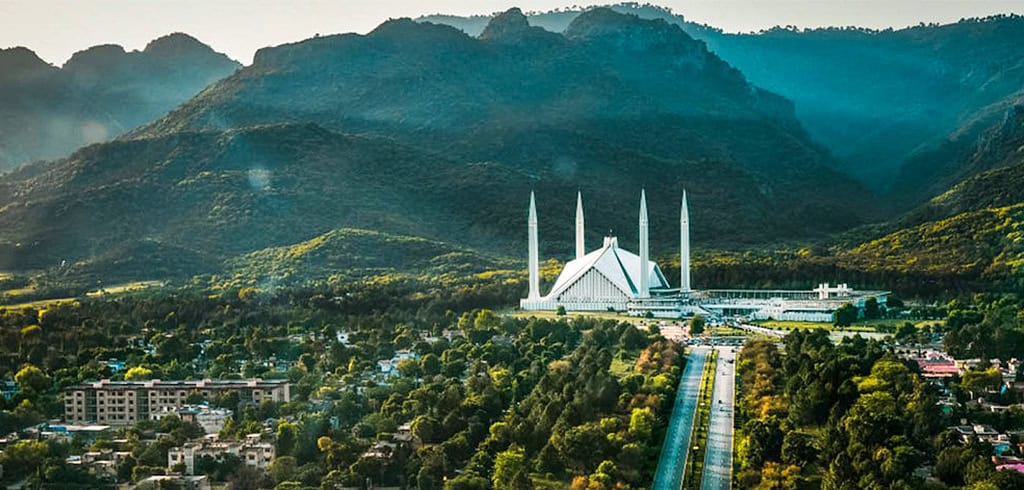

- Exploring the Modern Infrastructure of Gulberg Islamabad: Residential, Commercial, and Environmental Developments

- A Comprehensive Guide to Gulberg Islamabad’s Infrastructure

- Gulberg Islamabad vs Other Housing Societies: Leading the Way in Water Solutions

- Avoid Risk: Invest Only in CDA Approved Housing Projects like Gulberg Islamabad