Big news is shaking the market. S&P Global has revised Pakistan’s sovereign credit rating outlook from negative to stable. That might seem like a minor adjustment in financial language, but for investors, lenders, and policymakers, this kind of shift speaks volumes. It’s a strong sign that global sentiment is warming up to Pakistan’s economic prospects and that trust is gradually being rebuilt.

For years, uncertainty overshadowed optimism. Headlines focused more on fiscal strain and external debt than on opportunity. But now, with this upgraded outlook, the tide appears to be turning. A better credit rating does more than improve optics — it lowers borrowing costs, boosts investor confidence, and signals that the country may finally be stepping away from crisis mode.

And the most interesting part? Real estate stands to benefit directly, and perhaps swiftly. In Pakistan, real estate has always been a preferred investment during upswings. When macroeconomic indicators turn positive, property markets often move first. Right now might be one of those rare moments when conditions quietly align in favor of bold, forward-looking investors.

What Is S&P, and Why Do Its Ratings Hold Weight?

Standard & Poor’s — better known as S&P — is one of the most trusted credit rating agencies worldwide. Its reports influence how countries, corporations, and institutions are viewed across global capital markets. But this isn’t guesswork. S&P examines risk, economic performance, and policy trends before making any judgment. So, when the agency adjusts its view of a nation, markets tend to listen.

For Pakistan, the shift from negative to stable is significant. It tells global investors that the country is moving in the right direction. Not perfectly — but steadily. This improved perception invites capital, reassures lenders, and energizes investment decisions. For those considering real estate, this is more than background noise. It’s a strong hint that better times could lie ahead — and that the door is opening for future gains.

A Closer Look: What Sparked the Change?

The impact of Pakistan B‑ rating on real estate is no longer speculative — it’s becoming visible. S&P reaffirmed Pakistan credit rating at B-, but changed its outlook to stable — a move that may seem modest on the surface, but one that can influence billions in capital flow. Previously, the “Pakistan B rating” carried baggage: fears of instability, fiscal imbalance, and inconsistent reforms. Now, the tone has shifted.

S&P cited several reasons: a renewed commitment to the IMF program, stronger policy implementation, tighter fiscal controls, and an improving external position. Foreign exchange reserves are climbing, the current account deficit is narrowing, and monetary policy has taken a clearer shape. These aren’t just positive signals — they’re indicators that the worst may be behind us.

The government responded with optimism. Investors responded with movement. The real estate sector, long sensitive to macroeconomic shifts, began attracting fresh attention — both from within the country and abroad.

Investor Confidence Reignited

An upgrade in outlook doesn’t just make for better headlines. It makes people move. Foreign investors, once cautious and hesitant, now have one less reason to sit on the sidelines. When the risk perception drops, opportunity feels closer. Pakistan’s name is returning to watchlists — not just for equities or bonds, but for real assets that hold value over time.

The country’s ability to access international markets improves. Interest rates may ease. The rupee gains some footing. And confidence — both local and global — starts to build on itself.

Look at the stock exchange. Activity has picked up. And as history shows, rising investor confidence often finds its way into real estate. Property feels stable. It’s tangible. It offers protection against inflation and currency fluctuations. With sentiment improving, property becomes a natural next move.

Why Property Might Be the Smart Play Right Now

Real estate doesn’t wait for perfect conditions — it moves with the first signs of change. And Pakistan is seeing exactly that. Inflation is cooling. Interest rates are less volatile. Borrowing might soon get easier. Put simply, people are more willing to commit.

The S&P rating Pakistan update has brought it back into focus. More investors are beginning to see the shift not as a blip but as a real trend. And property, long seen as a hedge against uncertainty, is once again a focal point.

Foreign reserves are strengthening. The rupee has gained stability. Remittances are rising, and much of that capital finds its way into property. Real estate is familiar. It feels safe. And for overseas Pakistanis, it’s still one of the most trusted ways to grow wealth at home.

With foreign reserves of Pakistan recovering and macro indicators stabilizing, areas like Gulberg are positioned to attract early movers looking for medium-to-long-term gains.

Hotspots to Watch: Cities Gaining from the Momentum

The upgraded rating is already shifting energy into Pakistan’s most active real estate markets.

Karachi is buzzing — particularly in DHA City and Bahria Town. New infrastructure is transforming access. Commercial projects are attracting attention. Areas that were once considered slow-moving are now gaining traction fast.

Lahore continues to expand, with strong demand along Raiwind Road and newer zones near Barki. Mid-tier buyers and overseas investors are focusing on developments with modern infrastructure and solid returns.

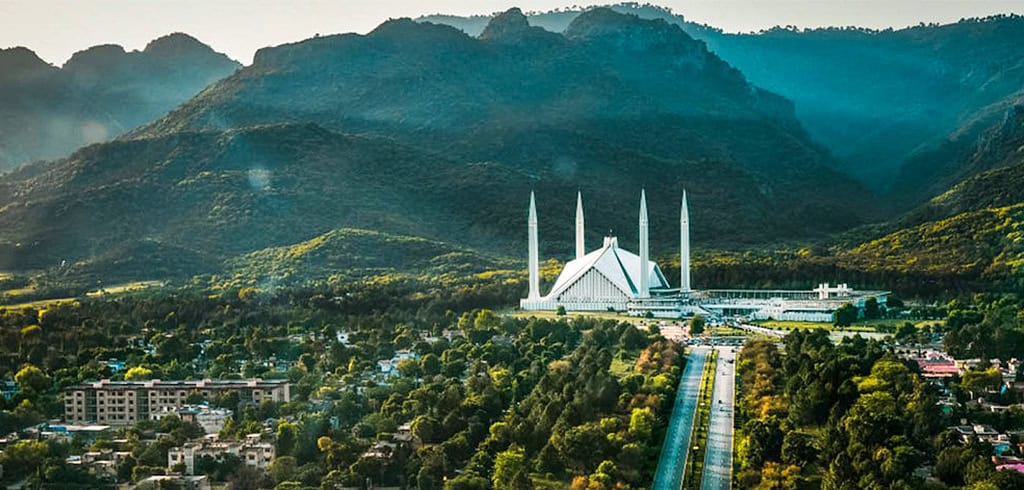

Islamabad is showing signs of sustained interest. The capital’s calm planning, combined with fiscal discipline from new government programs, is luring both institutional and individual investors. Areas in sectors E, F, and G are drawing attention for their long-term appeal.

Then there’s Gwadar — still in slow motion, but never off the radar. With CPEC still on the agenda, long-horizon investors are quietly positioning. Multan and other Tier-2 cities are also seeing demand pick up due to new road networks, housing schemes, and commercial development.

Confidence is building. And these cities are catching the early wave.

Watch Your Step: Risks Remain

Stability is returning, but caution still has a place. Currency volatility hasn’t vanished. Political shifts can pause or reshape development plans. The market looks better, but it’s not risk-free.

Legal checks are essential. Ownership documentation, land titles, and zoning regulations need to be confirmed, especially for overseas buyers who may not be on the ground.

Another key point: developer credibility. Fancy websites and glossy brochures can’t replace a proven track record. Do your research. Choose partners who deliver.

Yes, the macro picture is improving — thanks in part to programs like the IMF Extended Fund Facility Pakistan. But solid investing always starts with sound decisions.

Expert Views & Market Momentum

Industry analysts are calling this a quiet pivot. Not a dramatic leap, but a clear shift in tone. The outlook stable reflects a better grip over fiscal consolidation Pakistan real estate market policies, and indicates reforms are beginning to stick.

Developers are already seeing increased traffic from overseas buyers. Agents in Karachi and Lahore report higher interest in gated communities, residential towers, and mixed-use projects. If momentum holds, some expect price growth in the range of 10–15% over the next 12 months.

The S&P Pakistan credit rating didn’t just change a number. It changed the conversation. And that change is already showing up in buyer behavior, lending terms, and project launches.

Final Thoughts: The Window Is Open

This isn’t just another update buried in financial reports. It’s a quiet but meaningful shift in Pakistan’s economic narrative. For investors with a long view, the real estate market stands out — strong fundamentals, improving confidence, and a clear rebound in sentiment.

Cities are waking up. Buyers are returning. Developers are building.

The conditions are better than they’ve been in years. And while nothing is guaranteed, one thing is clear: this may be a rare window — and it won’t stay open forever.

Make your move while the signals are still clear. Because timing, in markets like this, is everything.