One of the most attractive investment opportunities today is to buy property in Pakistan. One of the most attractive investment opportunities today is purchasing property in Pakistan. With the rapidly growing Pakistan property market, people are looking for safe and profitable opportunities to secure their future. Whether you want to buy a house, a commercial facility, or a piece of land, the correct procedure secures your finances, and your deal is legally valid.

But do you know what exact steps you need to follow before signing the deal? However, in this real estate buying guide for Pakistan, we’ll break down the complete procedure step by step so you can confidently invest without stress.

Market Research & Budget Planning

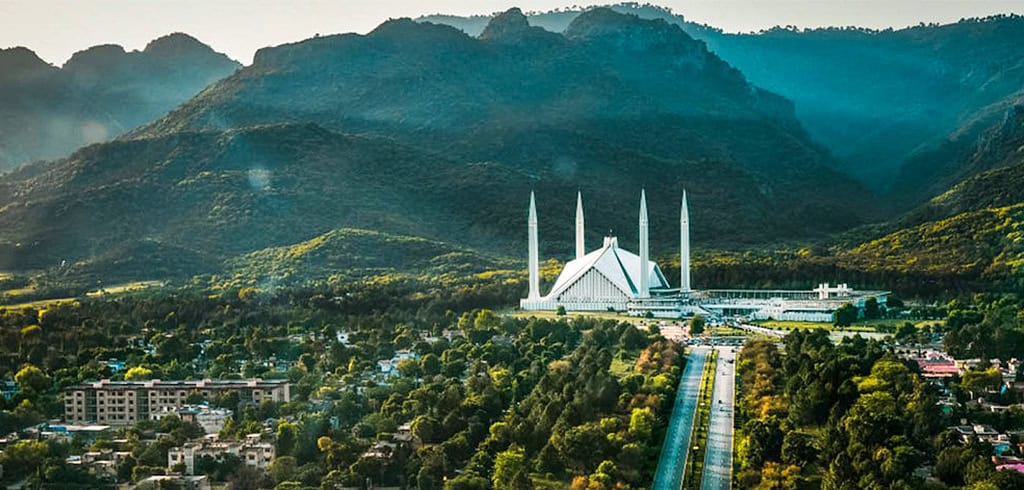

The first step in the plot buying process in Pakistan is thorough research. Where do you want to invest? Major cities like Karachi, Lahore, and Islamabad are on the rise, whereas Gwadar, Multan, and Faisalabad are on the rise as a result of new projects.

In addition, make a decision on whether you would like residential or commercial property. Comparing commercial real estate with residential real estate, keep in mind that residential investments are usually a safer long-term investment, whereas commercial projects can be more profitable, though riskier.

At this point, establish your budget. Therefore, don’t just consider the property price—include agent fees, lawyer charges, registration costs, and taxes on property purchase in Pakistan. However, having a realistic budget set in advance will save you time and help you concentrate on the properties you can really afford. Careful planning is the key when you decide to buy property in Pakistan, ensuring your investment stays within safe financial limits.

Verify Property Legality

Property verification in Pakistan is one of the most critical steps. It is always important to demand ownership papers like the title deed, allotment letter or transfer letter. Ensure that the house is not involved in conflicts and bad loans.

When purchasing in a housing society, ensure that you get the society with an NOC (No Objection Certificate) by the corresponding organisation, such as CDA, the LDA, KDA, or DHA. This check-up will protect you against any future complications.

Engage a Real Estate Agent or Lawyer

Do you want a smoother and safer experience when you buy a property in Pakistan? Then, hiring a reliable real estate agent is highly recommended. Agents know the local market, provide verified listings, and negotiate better deals on your behalf.

For maximum protection, involve a lawyer, too. A property lawyer ensures your documents are authentic, reviews contracts, and handles the property transfer procedure in Pakistan with full legal compliance.

Token Money & Sale Agreement

Once you’ve selected the property, the seller may request a token deposit to reserve it. This small deposit secures your interest.

Next, both parties sign a written sale agreement. It should clearly mention the property details, payment plan, and possession date. Having everything in writing avoids disputes later.

Due Diligence & NOCs

Before making the final payment, carry out due diligence. Check for utility connections such as water, gas and electricity, and ensure there are no unpaid bills. Always collect the necessary NOCs from the concerned authorities.

Payment & Transfer Process

Make payments only through legal banking channels. Cash payments are risky and difficult to prove in the event of a dispute.

For the property transfer procedure in Pakistan, the buyer and seller must visit the registrar’s office or the authority office. Biometric verification is usually required to finalise the transfer.

Registration of Property

The next step is property registration. A sale deed is prepared on stamp paper and signed by both parties. At this point, you will need to pay stamp duty, capital value tax (CVT), and registration fees. Once registered, you officially become the lawful owner.

Taking Possession

After registration, you can take possession of your property. Make sure utilities are transferred in your name and physically inspect the property to confirm everything matches the agreement.

Conclusion

Now you understand the complete plot buying process in Pakistan. However, in Pakistan, the risks and fraud are avoided by careful planning, checking of properties, and timely registration of property.

If you are an overseas Pakistani buying property, these steps are even more critical. Moreover, it is important to work with reputable or trusted developers or agents who can also help you through the process.

So, are you ready to buy property in Pakistan? It is your first home or a long-term investment, you can be sure that you have a future with the ever-growing Pakistan property market, if you follow this guide to buying real estate in Pakistan.

FAQ’s

Read More

- Rising Economic Optimism in Pakistan: What It Means for Real Estate Investment and Growth in 2025

- Avoid Risk: Invest Only in CDA Approved Housing Projects like Gulberg Islamabad

- Plot Turnover & Infrastructure Delivery: What Buyers Need to Know

- Legal Challenges in Property Allotments: How Gulberg Islamabad is Resolving Them?